You Work Hard and So Do Your Taxes

YOU MAY BE ABLE TO WRITE OFF UP TO 100% OF THE PRICE1 OF A NEW CHEVROLET VEHICLE

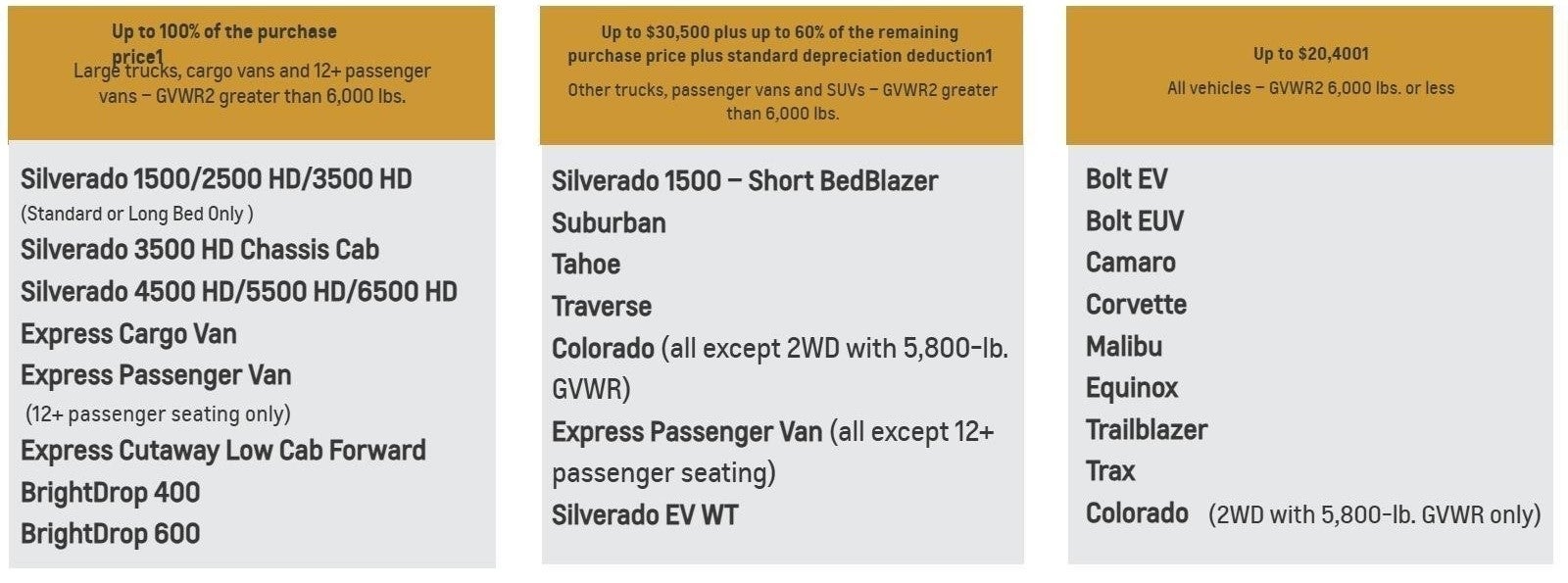

Chevrolet has been working hard to help get the job done at your worksite. And thanks to recently announced tax laws, your business may be eligible to immediately deduct up to 100% of the purchase price1 of qualifying new Chevrolet vehicles purchased in 2024 for business use.

With these tax laws in place, it's a great time to add the dependability of Chevrolet cars, trucks and SUVs to your small business. To learn more about current offers, contact your dealer or visit www.chevrolet.com/tax-deductions .

YOU MAY BE ABLE TO DEDUCT:

PLUG INTO AN EV TAX CREDIT

Individuals, businesses and tax-exempt organizations that purchase a qualifying electric vehicle may qualify for a federal Clean Vehicle or Commercial Clean Vehicle income tax credit of up to $7,5003 for vehicles placed in service in a trade or business during 2024.

Each purchaser’s tax situation is unique and the available tax benefits and the applicable federal tax laws, regulations and guidelines are subject to change without notice. Therefore, customers must consult their tax advisor to determine the proper tax treatment of any vehicle purchase(s). For more information, visit www.irs.gov. This advertisement is for informational purposes only and should not be construed as tax advice or as a promise of availability or amount of any potential tax benefit or reduced tax liability.

1 Taxpayers may be entitled to U.S. federal income tax deductions and/or credits for purchases of vehicles that are placed in service in a trade or business during 2024. Determining the proper income tax treatment of any vehicle purchase requires careful consideration of several factors including, but not limited to, the applicable tax laws, regulations and guidelines, characteristics and attributes of the particular vehicle purchased and the purchaser’s income tax situation. Each purchaser’s tax situation is unique and the available tax benefits and the applicable federal tax laws, regulations and guidelines are subject to change without notice. Therefore, customers must consult their tax advisor to determine the proper tax treatment of any vehicle purchase(s). For more information, visit www.irs.gov. This advertisement is for informational purposes only and should not be construed as tax advice or as a promise of availability or amount of any potential tax benefit or reduced tax liability. 2 When properly equipped; includes weight of vehicle, passengers, cargo and equipment. 3 Individuals, businesses and tax-exempt organizations that purchase a qualifying electric vehicle for use in a trade or business may qualify for a federal Qualified Commercial Clean Vehicle income tax credit of up to $7,500. For more information, visit https://www.irs.gov/credits-deductions/commercial-clean-vehicle-credit. Individuals who purchase a qualifying electric vehicle for non-business use may qualify for a federal Clean Vehicle income tax credit of up to $7,500, subject to additional restrictions. For more information, visit https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after. Consult your tax advisor to determine the proper tax treatment of any vehicle purchase(s) including, without limitation, which vehicles qualify, the amount of the available credit, how to claim the credit, how claiming a credit may impact other tax deductions and/or tax credits and for additional restrictions and limitations. Clean Vehicle and Commercial Clean Vehicles tax credit amounts, eligibility requirements and other requirements, restrictions and limitations are subject to change without notice.

Deacon Jones Chevrolet of La Grange

6595 Us Hwy 70, Lagrange, NC 28551

Contact UsHours

| Monday | 9:00AM - 7:00PM |

| Tuesday | 9:00AM - 7:00PM |

| Wednesday | 9:00AM - 7:00PM |

| Thursday | 9:00AM - 7:00PM |

| Friday | 9:00AM - 7:00PM |

| Saturday | 9:00AM - 5:00PM |

| Sunday | Closed |

| Monday | 8:00AM - 5:30PM |

| Tuesday | 8:00AM - 5:30PM |

| Wednesday | 8:00AM - 5:30PM |

| Thursday | 8:00AM - 5:30PM |

| Friday | 8:00AM - 5:30PM |

| Saturday | Closed |

| Sunday | Closed |

| Monday | 8:00AM - 5:30PM |

| Tuesday | 8:00AM - 5:30PM |

| Wednesday | 8:00AM - 5:30PM |

| Thursday | 8:00AM - 5:30PM |

| Friday | 8:00AM - 5:30PM |

| Saturday | Closed |

| Sunday | Closed |